- Supply-chain stresses in the US eased for a second straight month in May, Oxford Economics said.

- Shipping backlogs eased, inventories continued to climb, and container rates fell through the month.

- Easing in the logistics sector can bring supply closer to demand and help cool inflation.

Supply-chain issues have been a major factor in creating the US's year-long inflation problem. New signals reveal the mess is steadily being cleaned up.

Today's inflation — which is running at the fastest pace since 1982 — boils down to a simple mismatch. Economic reopening saw Americans rush back to their normal spending habits armed with pent-up demand and stimulus dollars. But while shoppers' demand rebounded almost immediately, companies were caught somewhat flat-footed. Product shortages quickly emerged and the imbalance between supply and demand contributed to historically elevated inflation.

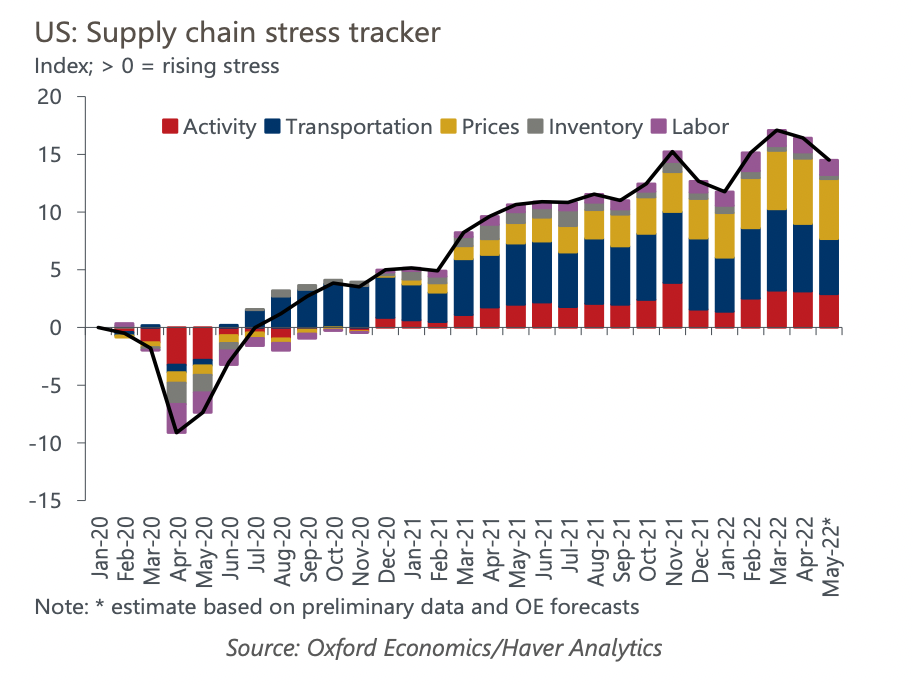

The supply side of the equation now seems to be steadily healing. Various indicators of supply-chain strain eased further in May after seemingly peaking in March, according to a new index created by Oxford Economics. Logistics stress is now the lowest its been since the start of the year, and the trend suggests improvement is accelerating as the broader economy nears a full recovery.

The number of cargo ships waiting to unload in the ports of Los Angeles and Long Beach, California fell for a fourth straight month in May, Oren Klatchkin, lead economist at Oxford Economics, said. Inventories rose, helping close the supply-demand gap as Americans' spending held strong. Prices for goods and services continued to climb, but at a slower pace than the month prior.

Smaller shipping volumes through non-ship transportation also signaled lower overall stress in the logistics sector, Klatchkin said.

To be sure, logistics stress remains well above the pre-pandemic average. The decline through May is only a minor dip in what's been a two-year surge following the lockdowns of early 2020. Supply-chain strain, as measured by Oxford's index, is roughly four times the average seen through the 2010s, and the gains seen since March only mark the start of what will be a long trek to normal conditions.

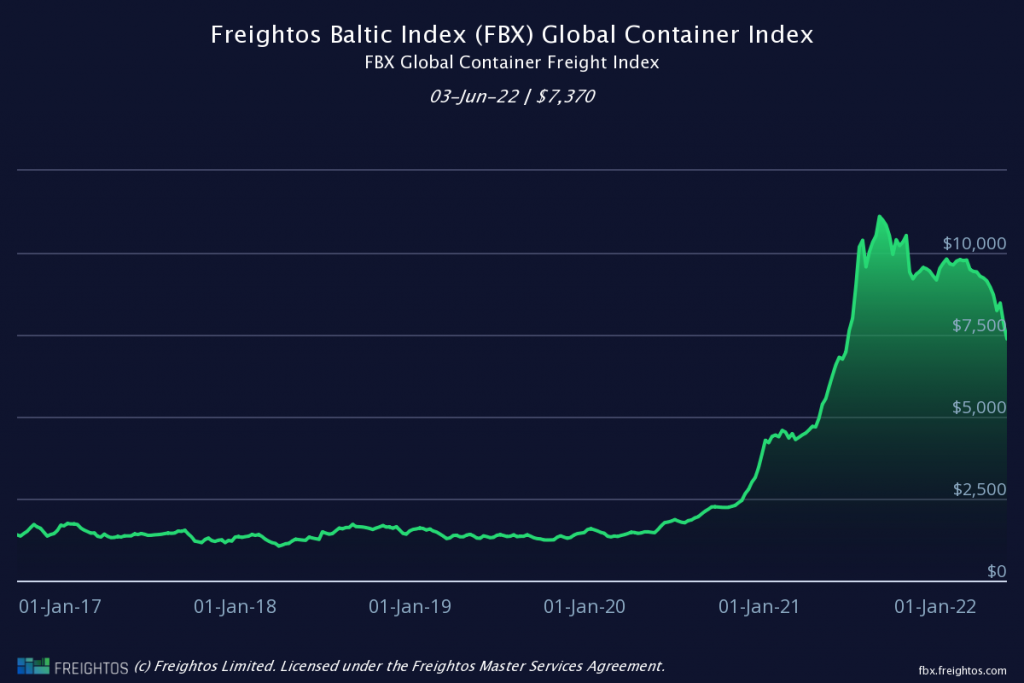

Still, market pricing points to a much more robust supply chain than that seen just weeks ago. The Freightos Baltic Index, which tracks rates for 40-foot shipping containers, fell to $7,370 for the week that ended June 3. That's the lowest reading since July 2021 and down from the September high of $11,100.

The steady decline in shipping rates offers an even rosier picture of the supply chain's recovery. The latest declines are among the largest since rates peaked in the fall of 2022. Lower shipping rates help ease inflationary pressures throughout the economy, as elevated prices in the logistics sector lead to higher input costs for all kinds of manufacturers and services.

The global supply chain might still be extraordinarily tangled, but as the economy pushes toward a new normal, that gap between supply and demand is steadily closing.

Dit artikel is oorspronkelijk verschenen op z24.nl